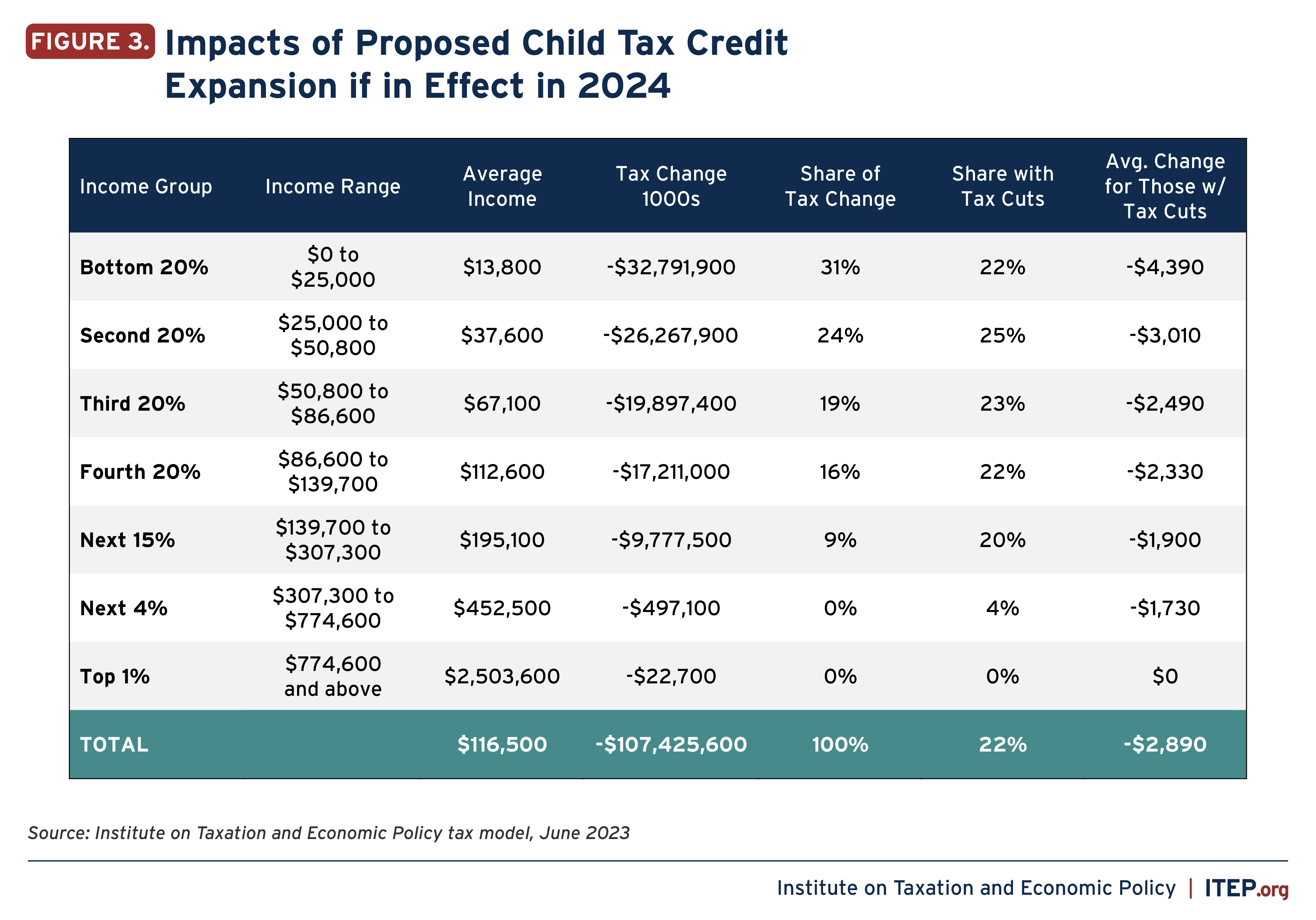

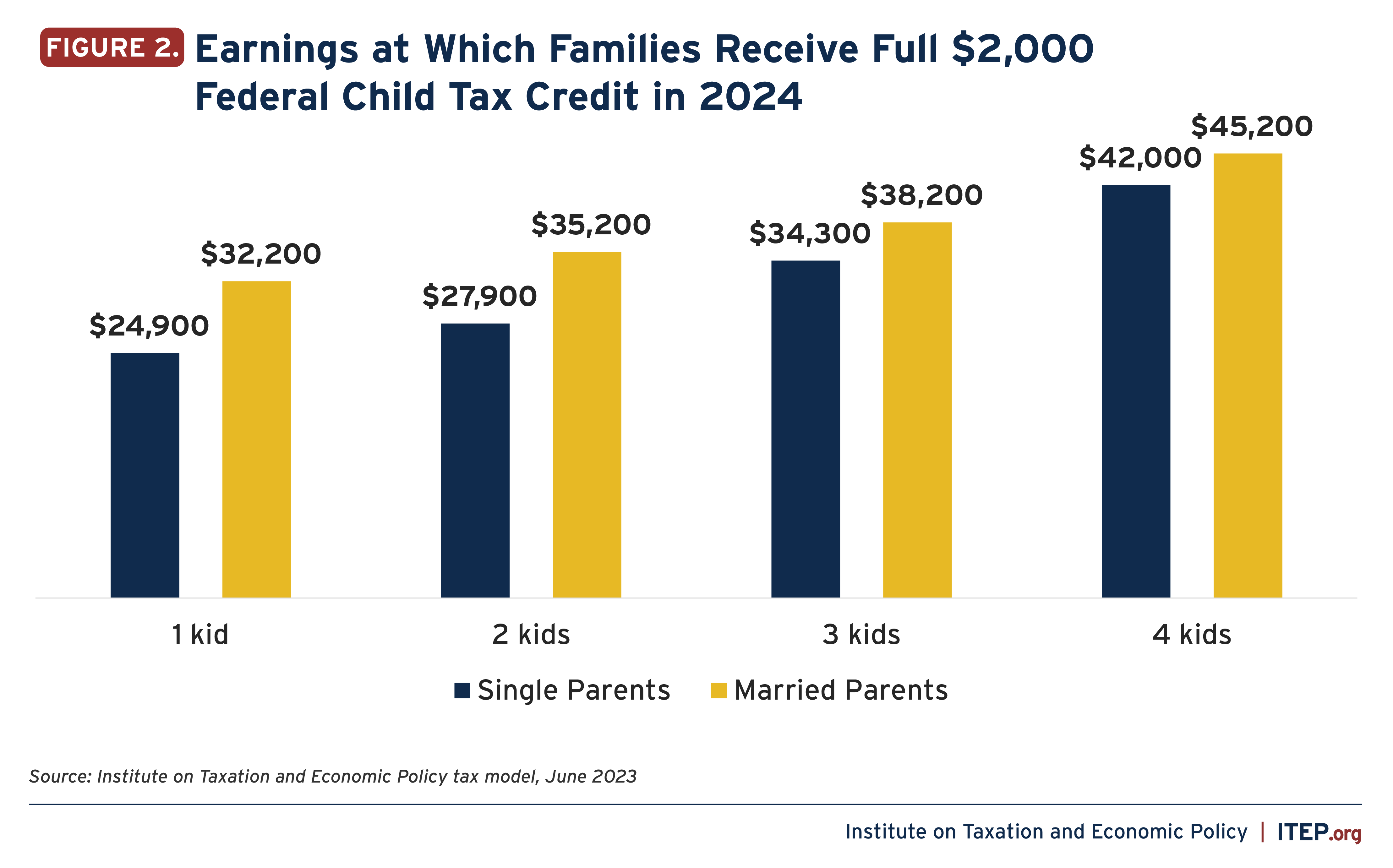

Child Income Tax Credit 2024 Application – In 2021, the CTC was expanded after the passage of the American Rescue Plan. That year the tax was raised to $3,600 per child under the age of six, $3,000 per child between ages 6 to 17, and it was . This essential benefit will be expanded. In a significant move, the House of Representatives voted on Wednesday to approve an approximately $80 billion deal aimed at expanding the federal child tax .

Child Income Tax Credit 2024 Application

Source : www.cpapracticeadvisor.comChild Tax Credit 2024: Eligibility Criteria, Apply Online, Monthly

Source : ncblpc.orgExpanding the Child Tax Credit Would Help Nearly 60 Million Kids

Source : itep.orgChild Tax Credit 2024: Will there be a Child Tax Credit in 2024

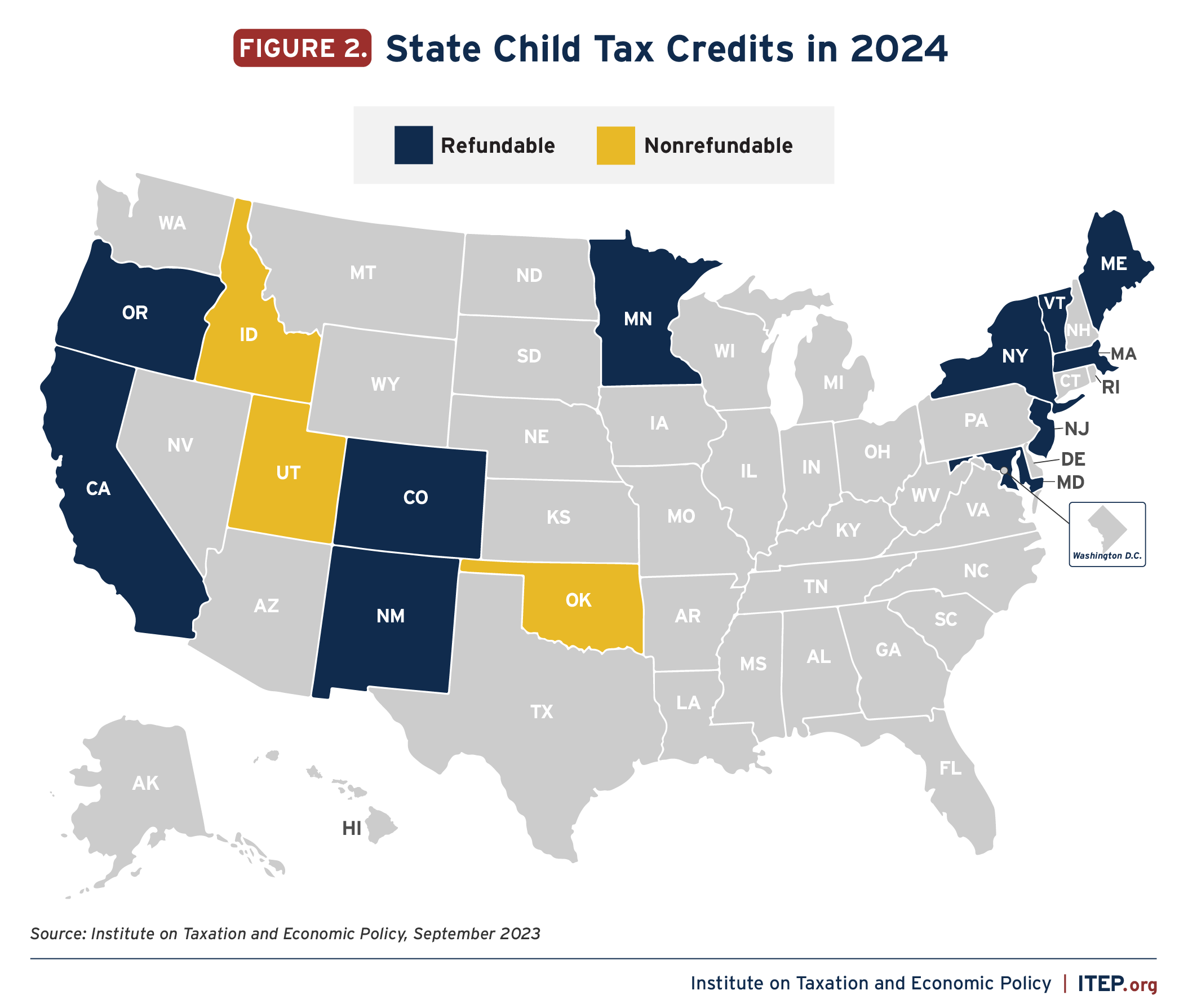

Source : www.marca.comStates are Boosting Economic Security with Child Tax Credits in

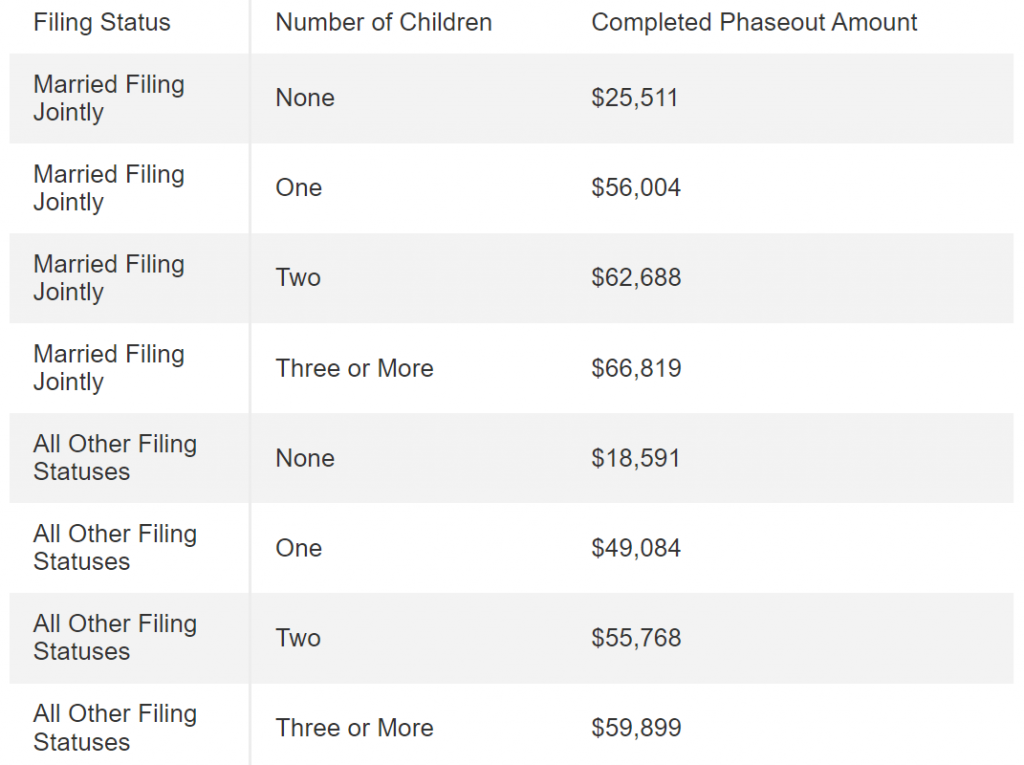

Maximum Earned Income Tax Credit for 2024 #eitc #credit #irs #2024

Source : www.tiktok.comExpanding the Child Tax Credit Would Advance Racial Equity in the

Source : itep.orgUSA Child Tax Credit 2024 Increase From $1600 To $2000? Apply

Source : cwccareers.inExpanding the Child Tax Credit Would Help Nearly 60 Million Kids

Source : itep.orgChild Tax Credit 2024: How much you’ll get per child this year

Source : www.marca.comChild Income Tax Credit 2024 Application Here Are the 2024 Amounts for Three Family Tax Credits CPA : Here’s why you may want to wait to file your federal tax return if you’re claiming the child tax credit this year. . Not all early tax filers will receive their refund in 21 days. Some claimed extra credits may delay your refund. .

]]>

More Stories

Barkus 2024 Lok Sabha

Beehive Movie 2024 Cast Members

Pickleball Slam 2 2024 Schedule